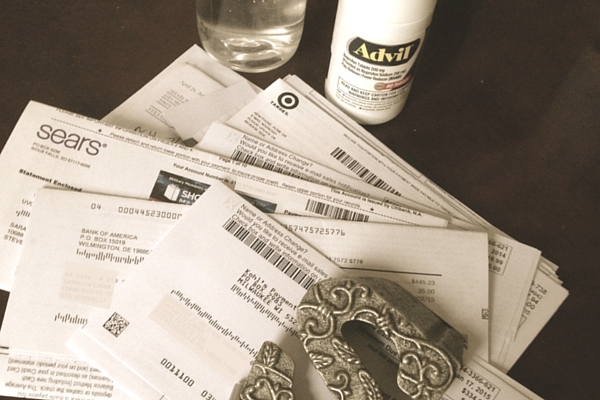

Christmas is over. The hustle and bustle has finally come to an end. The zillions of parties, events and obligations have finally stopped overcrowding your schedule. And now the dreaded task of putting all the decorations away is staring you in the face. Not to mention that runs to the mailbox aren’t nearly as exciting and for some of us can down right cause anxiety attacks. Unless you are the person who plans for everything out of cash and never, ever, EVER, forgets that one gift, you probably have a few unexpected expenses or bills coming in over the next month. Here are my tips for curing your Holiday Spending Hangover.

- Face It Head On. Ok, so you got a little wrapped up in the holiday spirit and bought everyone plus their brother a gift for Christmas, not to mention a few Secret Santa gifts for yourself. When you’re spending so much out of your normal routine it’s easy to lose track of what you spent where. You may have used store cards you never normally use or a credit card only used for emergencies. (That new Christmas sweater seemed like an emergency at the time.) Now is the time to gather up all that info. You don’t necessarily have to wait for a bill to come in the mail; most credit cards and store cards all have online access. So sign up, access your account and find out how much you owe and when. (Personally, I love it when the bill comes in the mail and I’m all like “Yep, I already know and I’ve got it covered! Ha! Take that Mr. Bill! No surprises here.”) Once you’ve got all that info, you can create a plan on how to pay it back. If it’s too scary to face alone, face it with a friend (particularly one that won’t judge you but won’t let you hide either).

Even if you didn’t blow your holiday budget and managed to keep things in check, managing all of the extra expenses can be challenging. Pay extra attention to your accounts while the dust settles, and remain flexible. If there are other expenses that can wait until next month, consider holding off. Stay in close communication with your partner so you’re both on the same page until things get back to normal.

- Don’t disown your spending decisions. You made them for one reason or another; own them. Try to understand why you made the decisions you did. Personal reflection can be a powerful motivator to change, helping you break free of the same old cycle. Taking the time to reflect back can help provide insight.

So grab your spending journal and take note on some things while they’re still fresh in your mind. What was the best part of your holiday season? Why? How do you feel about how much you really spent during the entire season (counting parties, food, decorations, all the little extras)? Would you allocate your resources differently in the future?

Reflecting on what worked for you and what didn’t can help you better align yourself with what’s really important to you in the future. Remember, it’s not just about money it’s about your values so don’t limit your reflection to just the monetary stuff.

Don’t let the weight of holiday expenses bring your down, resolve to manage it and keep your future spending true to what’s really important to you.