Time + Interest = A BIG Difference in Your Return!

When you invest your money, you are saving it with an expectation of a return. The return you receive can have a significant impact on your savings, especially over time.

For example, if you earn a rate of return of 3% on a $10,000 investment over 40 years, you will have $32,620. If instead you earn 6%, you will have $102,857. That’s a big difference!

Remember that phrase “compounding interest”? That’s what’s happening here but instead of it working against us like it does with loans, it’s helping us out with our savings. Your interest is earning interest. It’s literally free money!

This concept is also why someone who saves earlier even with just a small amount of money will end up with more than someone who saves a lot of money over a shorter period of time.

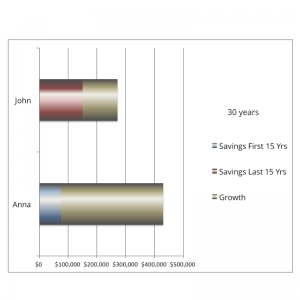

To illustrate this, let’s look at two investors over a 30-year period. Anna decides to save early and saves $5,000 a year over the first 15 years. She stops saving but allows it to grow earning 8% over the next 15 years. John doesn’t save right away, in fact waits 15 years to start. In order to make up for lost time, he saves twice as much a year ($10,000) for the remaining 15 years. He also earns 8%.

Look at the difference at the end of the 30-year period. John’s account balance is worth $271,521 but Anna’s is $430,653! Even though John saved twice as much as Anna, her money had more time to grow. She ended up with more… much more!

Look at the difference at the end of the 30-year period. John’s account balance is worth $271,521 but Anna’s is $430,653! Even though John saved twice as much as Anna, her money had more time to grow. She ended up with more… much more!

I think this makes us all want to be like Anna. There are two parts that make her scenario work though… two very important parts.

First, keep the money invested.

When I was first encouraged to start saving for retirement, I wasn’t even old enough to participate in our employer retirement plan. Despite that, I found a way to invest a small amount of money. Less than three years later, though, I cashed it out. It seemed like such a small amount of money at the time. (I think it was less than $1,500.) Oh, how I wish I could redo that decision! That little bit of money would not be so little now. (I figure it’d be worth about 5,000 now and in another 15 years, $15,000!)

Secondly, keep earning interest.

If you don’t keep earning the same average rate of return, you won’t have the same results. That’s why it’s important to monitor your investment. Sometimes people move their investments to cash for various reasons. If left in cash for too long, you interrupt the compounding process.

Understanding how time and the rate of return you earn impact your savings is important in developing your own investment strategy. If you are saving over a 30-year period, you have a long time before you need that money. The rate of return you earn is going to have a larger impact. Investing in something that is only earning you an average of 3% is probably not the best strategy. (This becomes even more evident when we start talking about inflation.)

Determining what investments to use in order to achieve the rate of return you are targeting is the next step. Considering your savings account is unlikely to earn you much more than 3% over time, we have to start looking at other investment options. It’s at this point we start talking about risk. Yikes! So stay tuned as we tackle that very topic next.